Loading Content...

Make & keep tabs on your development toward short & long objectives

View Detail

View Detail

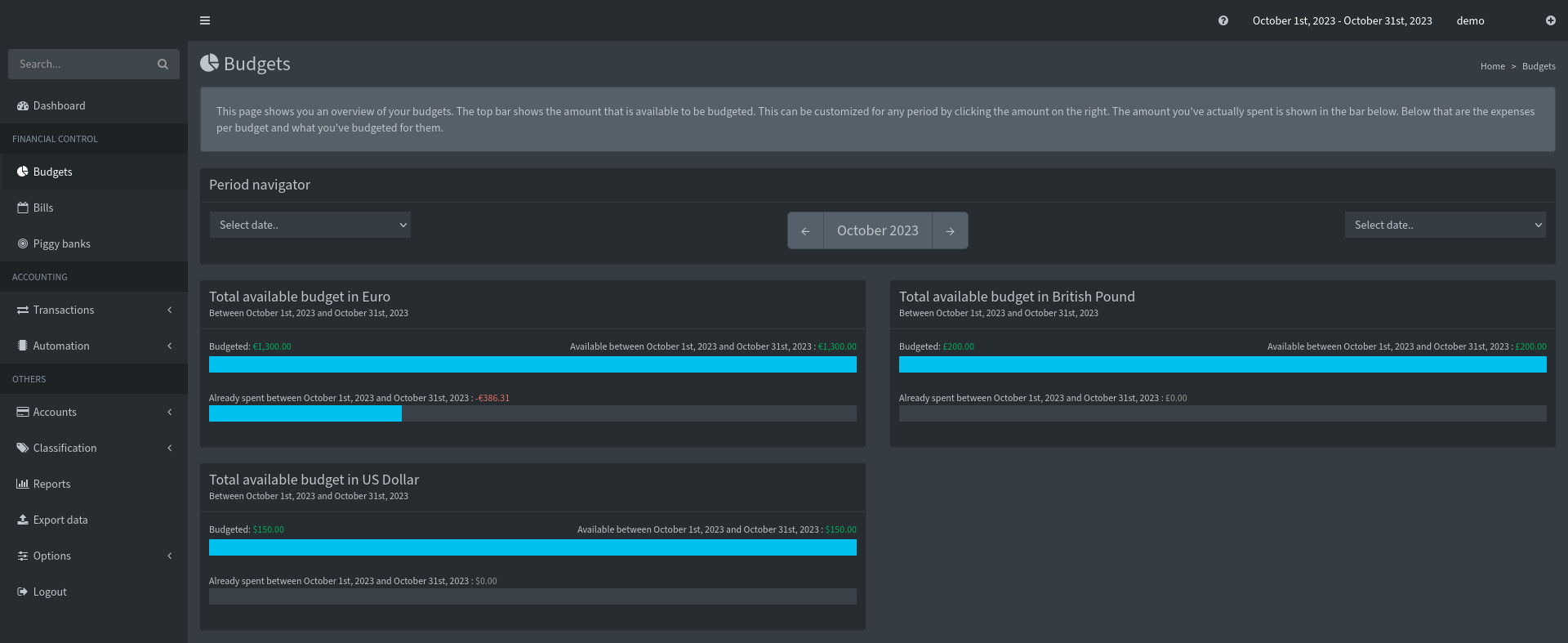

Could it be a great idea to incorporate last month's financial transactions into this month's budget? You'll consistently find yourself in a favorable position. Believe us, it will bring a truly pleasant feeling.

View Detail

View Detail

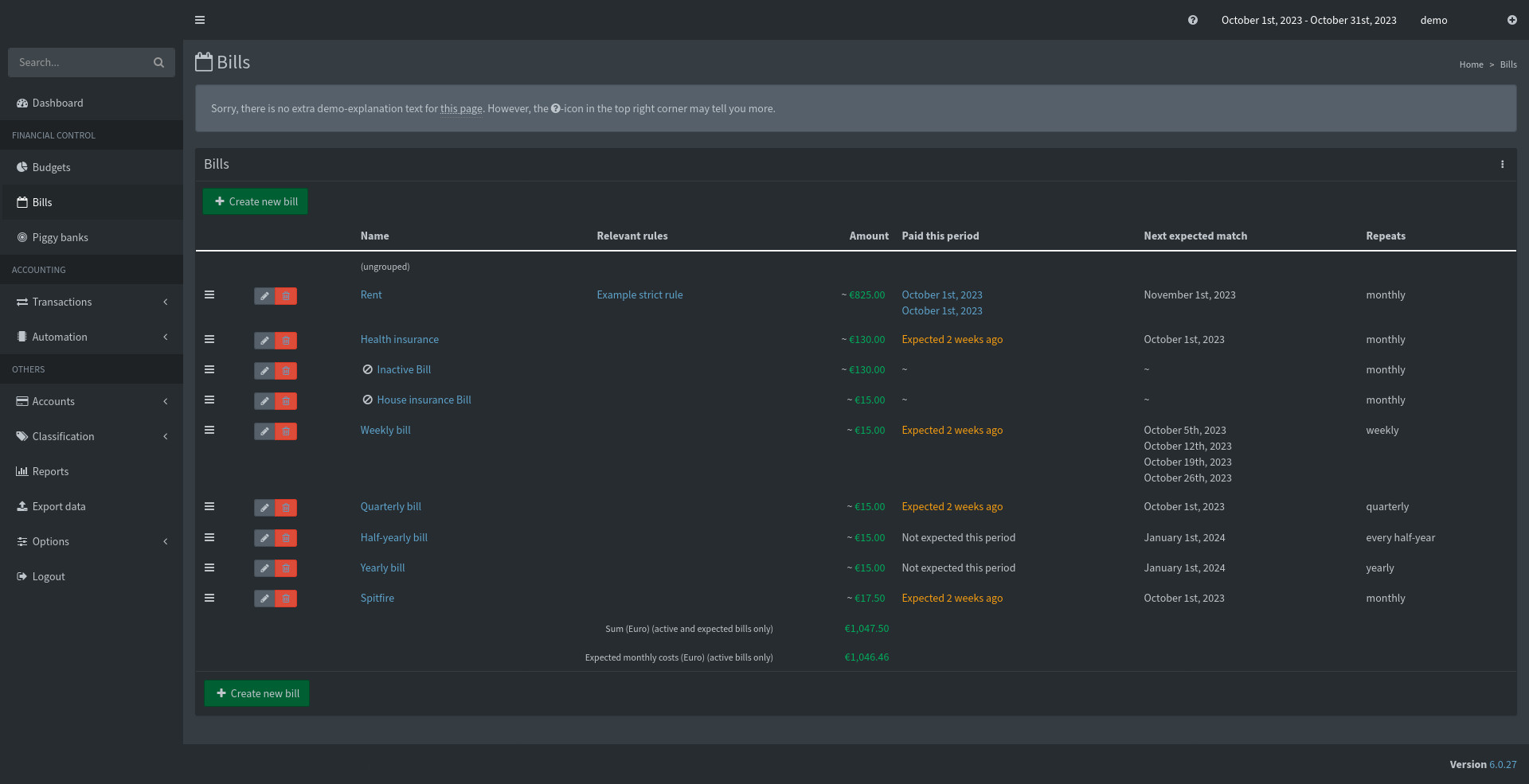

Non-monthly expenses, such as car repairs and seasonal shopping, are a reality we cannot avoid. To manage these budget disruptors effectively, break them down into smaller monthly allocations.

View Detail

View Detail

Financial plans that are inflexible are prone to breaking. Stay adaptable. When life undergoes changes, adjust your budget accordingly. No need to feel guilty – it's your money, after all.

View Detail

View Detail

Reiterate your financial priorities by determining what you want your money to achieve before you receive it. Ensure that each money has a meaningful role, making your financial plan clear and purposeful.

View Detail

View Detail

Achieve clarity and assurance with these four straightforward yet highly effective principles. The magic doesn't reside in the numbers; it's all about the strategy.

View Detail

View Detail

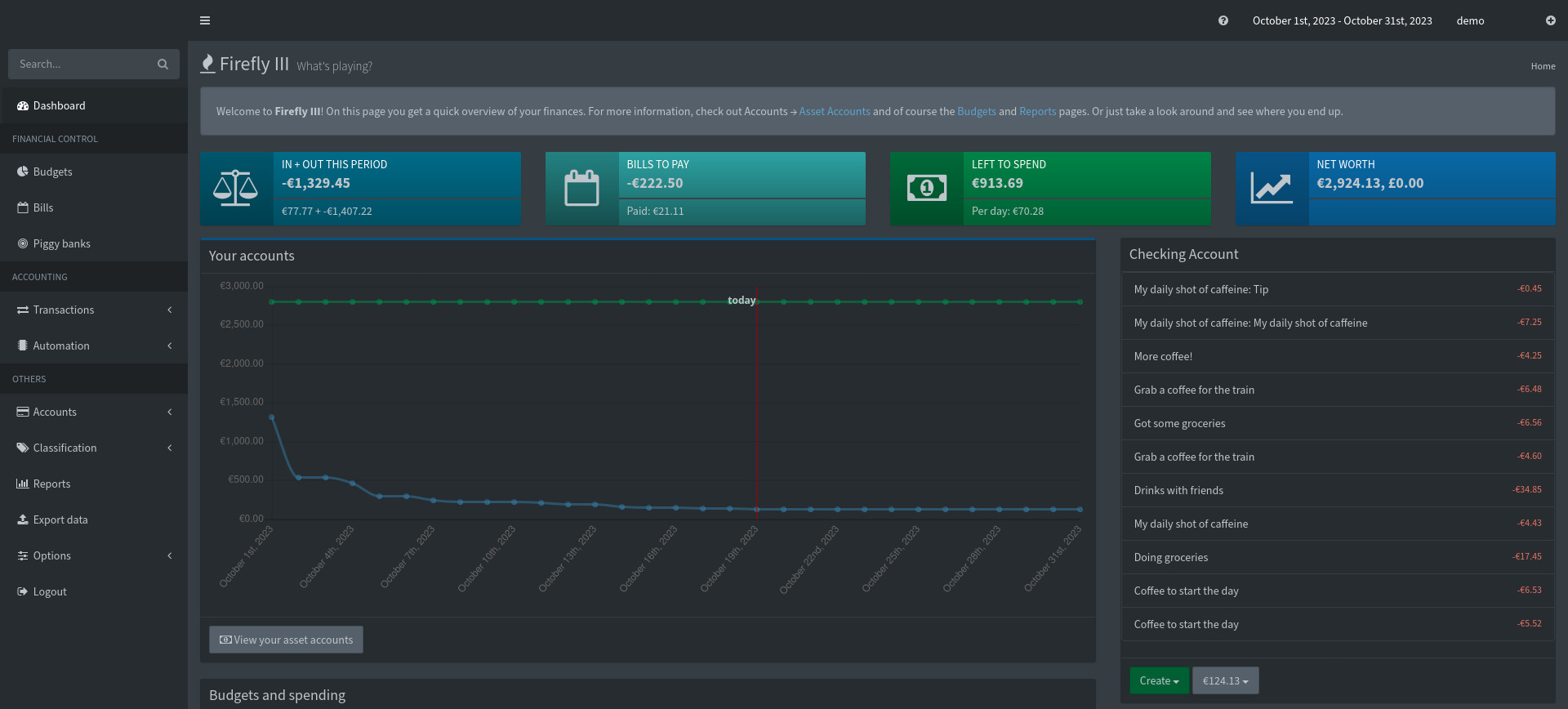

Utilize insights to boost your savings, enhance your budgeting, and reach your goals more quickly. Key alerts, built-in reports, and income projections make planning easier.

studiosavings.net has advanced reporting capabilities, allowing you to track your expenses on a weekly, monthly, or yearly basis. Moreover, it can assist you in auditing your accounts with detailed summary views. You can even compare budgets or use tags for better financial management. It offers a wide range of possibilities.

Identify your specific needs. Do you prefer working with tags? Are you looking to budget your expenses? Do you want to organize all your hobby-related costs? Look no further. Studiosaving.net supports various features. You can expand your budgets with limits in multiple currencies, allowing you to budget both your everyday household expenses and what you spend in Galactic Credits while visiting Tatooine.

These applications assist users in monitoring their expenses by recording and categorizing their spending. Users have the option to manually input their transactions or connect their bank accounts and credit cards for automated tracking. Budget and bill management apps frequently incorporate bill reminder features. Users can establish due dates for recurring bills and receive notifications to prevent late payments.

Financial Writer

Financial Assistant

Trust Officer